It’s no secret that luxury vacations are an investment. I mean, a pretzel costs $5 at Disney World! Why would a pretzel ever be worth $6? Well, because it’s Mickey shaped, that’s why. There are plenty of ways to save for your dream vacation without losing your mind though. Next week, I’m leaving on the ultimate getaway where I’ll spend 35 days in Disney Parks. I’ll be in the Orlando area for 28 days and 7 days in California at Disneyland. Mostly because, duh, it will be fun. My parents also want to check out some condos in the Orlando area for retirement. After that, I’m attending a theme park blogging conference in Anaheim. I know, rough life!

I’m not here to brag though.

To accompany this post, I made a video where I explain why I chose each hotel and the discounts I used in order to cut down costs. It also includes cheesy music and random pictures of Disney snacks. Worth the watch! I’ll be uploading new videos once I start my adventure, so definitely subscribe!

Saving takes time, patience, and envisioning yourself on the beach with a margarita and booty shorts.

Yes, I did just quote myself on my own blog. It’s still a free country.

5 Tips to Save & Pay for Your Vacation Easily

Now, I understand some of what I say comes from a place of certain privilege. I don’t have kids and I share expenses with my live-in boyfriend. Livin’ that dink life. Not everything I tell you will apply to your situation. That said, saving for my gratuitous Disney vacation was tough and I definitely make below average income, so I have plenty of advice to help you out.

#1 Create a Vacation Savings Account

I created a savings account completely separate from my Checking and Life Savings (not much in there at the moment, to be honest). This allowed me some self-control and forced me not to touch my vacation account for boring things like bread and toilet paper. The money is out of sight, out of mind. Putting your money away into a separate account allows you to pretend that it doesn’t exist. That money will feel like it disappeared and there’s no way of getting it back. That is, of course, until you start making payments towards hotel stays and flights. Navigate your self-control by imagining what life will be like once you’re on vacation. The bliss you feel when the sun is in your hair and soaking your feet in the pool. That’s the end game.

#2 Make a Deposit Every Month

Now that you have a place to store your money, it’s time to fill it up until it’s bursting with cold, hard cash. I started saving for this vacation a year and a half ago. It was not an overnight procurement. It took me working a full-time corporate job and planning Disney vacations for commission as a side hustle. That’s 1 1/2 jobs for 1 1/2 years to make my Disney dreams come true. As for the amount, I made it a goal to deposit $250 on every paycheck. Roughly, this means I saved $9,000. I did not need this much money and I used some of it for other things once I had enough to cover my vacation. How much and how often you make a deposit is completely up to your financial situation. Do try to set an amount and frequency instead of random amounts at random times. It helps reach your goals a little quicker.

#3 Pay for Your Vacation in Chunks and Don’t Hesitate!

When a cheap flight appears on Kayak.com, snatch it up. If you see an awesome deal for your dream hotel, put that deposit down. You’ve already made up your mind that you’re taking the vacation, so don’t hesitate. Like a metaphor for Carrie Bradshaw’s love life, I can’t tell you how many times I passed up an awesome deal because I felt like something better was going to come along. Once you pay for a piece of your vacation, it’s out of your hands and your plans are set. The money is gone and the only thing left to do is go on your vacation. Also, paying for your vacation a little bit at a time will not only be easier on your spending account, but it will feel better too. Plus, most hotels will allow you to make changes or apply discounts once you put down your deposit. Disney is especially notorious for this.

#4 Use Rewards Programs

I’m not going to pretend I’m some financial wizard, but I do use a lot of rewards programs to my advantage. One of the ways I helped save for my vacation was by paying for everything from groceries to flights with my credit card. Then, I would immediately pay everything off and get cash back for my purchases. This ended up saving me about $300-400 on my entire vacation. I’m not advising maxing out your credit cards by any means. Do what makes the most sense for your situation. Rewards programs don’t necessarily mean credit cards either. There are many travel rewards programs that will help you save some money or allow you extra benefits. If you love flying Alaska then sign up for their mileage program and if you only stay at the Hilton, be sure to use Hilton Honors. Do what makes sense for your travel preferences.

#5 Bring a Friend or Your Mom

My mom and I travel together a lot. We split the cost, share a room, and sometimes even a bed. (You’re never too old to share a bed with your mama.) We share meals and cocktails because it cuts down on cost and also because we’re total lightweights. The more friends you bring, the less your hotel will cost and the more fun you’ll have with your chums!

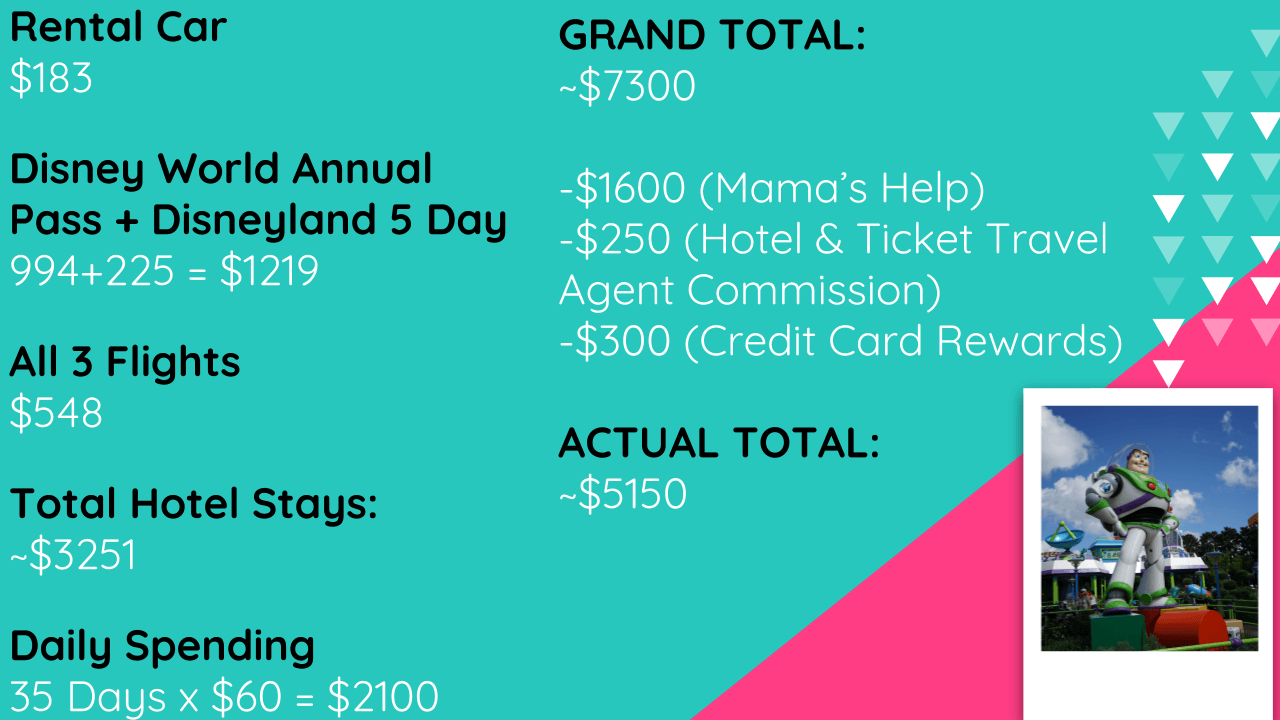

Budget Breakdown: How Much a 35 Day Disney Vacation Will Cost

Talking about money is no picnic. I get

Cost #1: Disney World and Disneyland Tickets

Disney World Annual Pass: I’ve visited Disney World twice in the last 6 months so it made financial sense to buy an Annual Pass and go into the parks as often as I want. I bought the Platinum Plus Pass which includes all four parks, both water parks, access to the ESPN Wide World of Sports, and Oak Trail Golf Course. This cost $994. In hindsight, I should have just bought the Platinum Pass for $894 and skipped the water parks and sports stuff. I’m not a sports lover and my adventure starts in February. Florida isn’t too cold in February, but it’s not always swimsuit weather either.

Disneyland 5-Day One Park Per Day Pass: I got a killer deal for the Disneyland ticket because the discount ticket seller, Get Away Today did a Black Friday deal that marked down the price considerably. My 5-day ticket ended up costing $225, about $115 off the regular price. It was so good we ended up buying tickets for my mom, brother, and his girlfriend. You’re welcome, Bob Iger.

Disney World Annual Platinum Plus Pass: $994

Disneyland 5-Day One Park Per Day Pass: $225

Grand Total: $1219

Cost #2: Flights

I’m traveling to two locations so I had to buy three flights. They ended up costing less than I anticipated. To track flight prices, I advise using Kayak.com, Airfare Watchdog, and good

Seattle–>Orlando (United): $177+$14 Flight Insurance

Orlando–>Los Angeles (Jet Blue): $255

Los Angeles–>Seattle (Alaska): $136

Grand Total: $582

Cost #3: Daily Spending

Grand Total: $60 x 35 Days = $2100

Cost #4: Hotel Stays

Choosing a resort is the hardest part of planning a Disney vacation. The number of choices will make your head explode. There are multiple benefits for staying either onsite or offsite and your hotel needs will be much different than mine. To help you decide, I wrote a guide to the Best and Worst Value Resorts, which you can read here.

Pro Tip: The Disney World website is super glitchy. One minute an awesome discount is available and once you refresh the page, it’s gone. Don’t panic! Clear your cache, go incognito, and try again. If something still seems amiss, call the hotel reservation hotline and talk to a Cast Member for quotes.

(407) 939-1936

Hotel Stay #1 – February 11-16: Disney’s All-Star Sports

Out of the three All-Star Resorts, Sports happens to be my least favorite. I also happen to be staying here for two of my vacation weeks. No matter. It’s still a very cute resort and extremely Disney-fied. The biggest advantage of staying onsite is that you get access to free transportation to/from the parks. That means no budgeting for a rental car! For this hotel stay, I snagged us an Annual Passholder discounted room.

Grand Total: $603

Hotel Stay #2 – February 16-24: Champions World Resort

I’ve yet to stay at Champions World Resort, but judging from the reviews, this place looks like a decent place to stay. The rooms look pretty good and the property is lush with Florida foliage and ponds. They also have sports fields, three heated pools, private hammocks, and fire pits. It’s also very, very cheap. Once we stay here, I’ll give it a proper review, just in case you’re looking for a dirt-cheap hotel that isn’t sketchy as heck.

Grand Total: $482

Hotel Stay #3 – February 24-March 1: Disney’s All-Star Sports Resort

As I said, I’m not a sporty person by any means and I’ve somehow booked myself two weeks at this hotel. Disney just happened to have a good discount on both weeks we needed a hotel. I have nothing to complain about though. Despite my inner musical theatre kid screaming for freedom from the Jocks, I love staying at any Disney resort. I used the Sun and Fun Room Discount to get a good deal.

Grand Total: $669

Hotel Stay #4 – March 1-March 10: TBD

We haven’t booked our hotel for this week yet! We’re living dangerously by not booking ahead of time, but I did set myself a max budget of $600. Also, do as I say, not as I do! I highly advise booking in advance to help you save money. The closer you get to the date, the more likely discounted rooms will sell out. On the other hand, Hotel Tonight doles out some awesome deals for last-minute planners like us.

Grand Total: ~$600

Hotel Stay #5 – March 10-March 17: Knott’s Berry Farm Hotel, California

This is the week we’ll head out to California for some Disneyland time and when I’ll attend the theme park conference. This hotel is set on Knott’s Berry Farm property with views of the theme park. Although, if you plan on staying here you will need to arrange for transportation to Disneyland. It’s not within walking distance.

Grand Total: $878.00

Additional Discounts

There are three deductions that I haven’t taken into account yet. The first advantage is that my mom is coming with me so she’s graciously paying for half of the hotel stay. How nice, right? The second is that I’m a Disney Travel Planner so I get commissions when I sell Disney vacation packages, even on my own travel. The last is that I paid for all of this with my credit card so I’m getting cash back on all my purchases.

Mom Fund: -$1600

Commission: -$250

Credit Card Rewards: -$300

Total Deductions: -$2150

SUPER GRAND TOTAL: ~$5,150

Note: The rental car is for the week we are staying at Champions World Resort so we’re not trapped in the hotel like cartoon rats.

Not too bad, eh? If you’re thinking I’m spending way too much money on this vacation, let’s put it into perspective. For $5,000 I could take a family of four to Disney World for one week. I’m going to Disney World AND Disneyland for 5 weeks total. I understand $5,000 is an investment and a lot of people wouldn’t be caught dead spending so much on a theme park. I get that it’s an odd thing to dedicate almost two years of your life savings to as well. Although, if you love the idea of taking some time off to take the vacation of your dreams, hopefully, some of my tips will motivate you. To finish this off, I’ve got two resources that will help you get started!

#1 – A Free Cheat Sheet: 15 Ways to Save on Your Disney Vacation

The first is my wildly popular downloadable cheat sheet. When you opt-in, you get a Disney World money-saving cheat sheet. Fill out the form below to get your free resources!

#2 – A Financial Motivator

The second resource is my all-time favorite and inspirational money-saving book: You Are a Badass at Making Money. A lot of my budgeting tips are inspired by Jen Sincero’s mindset and can-do attitude. I promise you’ll eat it up!

More Disney Posts You’ll Love!

- Easy Guide to Genie+ and Individual Lightning Lanes – Disney Ride Strategy!

- Newsletters & The Best Email Service Provider for Travel Agents

- What is the Best Marketing Tool for Travel Agents?

- How to Become a Successful Travel Agent with No Experience

- Top 5 Affordable Cities Near Disney World 2022

Pin it for later!